If this happens, we will notify you. Our notice will tell you why you have been overpaid and how you can pay us back. Request for Waiver of Overpayment Recovery. Social Security Administration.

When To Complete This Form. Check any of the following that apply. Also, fill in the dollar amount in B, C, or D. I cannot afford to use all of my monthly benefit to pay back the overpayment.

However, you do not have to pay it all back at once. From your description, you did not overpay social security. To overpay, you would need more than one employer and the sum of the wages of all your jobs would need to exceed the maximum earnings subject to social security tax.

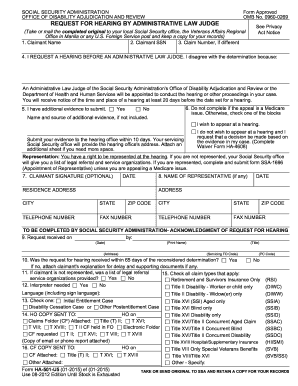

If we continue to deny your waiver request upon reconsideration, you may appeal the determination by requesting an Administrative Law Judge hearing (see Appeals Process). How long does payment processing center for SSDI take? How to fill out form ssa-561? Get Your Replacement Card From Home. If the total overpayment is $000.

Name of person on whose record B. Waiver Provisions for Title II and Title XVIII Overpayments - Table of Contents. If approve you may avoid paying back some or all of the total balance the SSA says that you owe. The fault of one individual is independent of the fault of any other individuals also liable for the overpayment. The person(s) liable for overpayment repayment must request a waiver before SSA will make a waiver determination. Technicians must make all SSI overpayment waiver decisions through the Modernized Supplemental Security Income Claims System (MSSICS) via Direct Supplemental Security Record (SSR) Update.

An overpayment is essentially when the government issues a check for more money than it should have paid. The amount of your overpayment is the difference between the amount you received and the amount you should have been paid. Or, if you do not respon they will just start lowering your check. You do not have to accept this. Once a final determination on the overpayment is made, the amount is a debt the individual owes to the federal government.

SSA may approve a waiver when the individual files the waiver form. If SSA cannot issue a favorable decision, it must schedule a personal conference before making a decision. Recoupment begins once the waiver application is denied. For more information, please click on one of the links on the left.

The SSA will notify you about it and inform you why an overpayment happened and how you will be able to pay them back. Generally, the answer is yes. That can be a big problem for some people, especially if they have been receiving overpayments for months or even years.

Report any changes of income or work on a monthly basis to the SSA, keep any supporting documentation that can help support you did everything the SSA asked of you, and be diligent about staying on top of your finances. If you believe you should not have to pay back the overpayment you can request the SSA waive collection. There is no time limit to file form SSA-6where you will request a waiver so you do not have to pay, but they will only grant this waiver if the overpayment was not your fault AND paying it back would cause financial hardship.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.