If this happens, we will notify you. Our notice will tell you why you have been overpaid and how you can pay us back. Request for Waiver of Overpayment Recovery. When To Complete This Form. Check any of the following that apply.

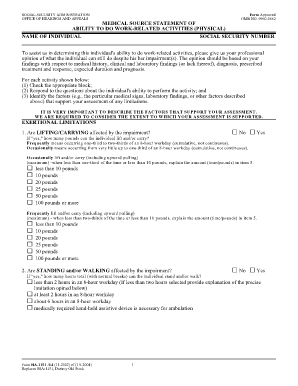

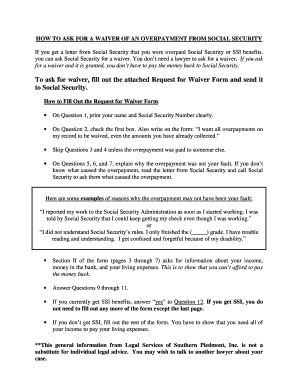

Social Security Number : 2. Also, fill in the dollar amount in B, C, or D. I cannot afford to use all of my monthly benefit to pay back the overpayment. However I can afford to have $ withheld each month. If SSA waives the overpayment , they will send you a notice stating so.

If SSA cannot waive the overpayment without more information (in effect, a first denial), the field office will send you a notice scheduling a Personal Conference. You should not postpone, skip, or cancel this Personal Conference! Policy for overpayment waiver requests. Technicians must make all SSI overpayment waiver decisions through the Modernized Supplemental Security Income Claims System (MSSICS) via Direct Supplemental Security Record (SSR) Update.

For waiver inputs, see MSOM BUSSR 004. The following are basic waiver policies. If we grant you a waiver , you will not have to repay all or part of the overpayment. You cannot pay back the overpayment because you need the money to meet your ordinary living expenses.

You may have to submit bills to show that your monthly expenses use up all of your income and that it would be a hardship for you to repay. However, you do not have to pay it all back at once. SSI recipients can ask for reconsideration of a request to waive an overpayment.

Full withholding would start days after we notify you of the overpayment. Can you go to jail for SSI overpayment? How much does SSDI pay?

Name of person on whose record B. Waiver Provisions for Title II and Title XVIII Overpayments - Table of Contents. I don’t know anyone who doesn’t get them. You can request a waiver when the mistake is their fault, not yours, and you can show a hardship for repayment, which might require proof of bills. In other words, you must prove that you didn’t intentionally withhold information the SSA needs to accurately calculate your benefits. If you failed to disclose anything that would reduce your payments, even on accident, this step gets much, much harder.

If you were overpaid Supplemental Security Income ( SSI ) benefits and are currently receiving SSI benefits, of your monthly benefit will be withheld each month to repay the overpayment. Development of Without Fault for a Supplemental Security Income (SSI) Overpayment Waiver A. Definition of without fault “Without fault” is the absence of-fault-in connection with causing or accepting the overpayment. Automatic Waivers for Small Overpayments.

There is no time deadline for requesting a waiver of an overpayment but it should be filed soon after receipt of the notice of overpayment to eliminate or limit the withholdings from future benefit payments. If you are a Supplemental Security Income ( SSI ) recipient, your SSI benefit amount is calculated on a monthly basis. Thus it is important to report any changes that occur in income or assets of the entire household on a monthly basis. Whether it is you, your spouse, or your child who is receiving SSI ,.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.