Military Pay and Pensions. Find information on basic pay, pensions , and retirement benefits for service members, veterans, and military retirees, including whom to contact with questions and concerns. The BRS allows you to choose a. The new system blends a fixed pension system like the. The amount of the pay is 2. The continuation pay is an incentive for military servicemembers to stick around to least years, usually past their initial enlistment or active duty service commitment (ADSC). Colorado – Depending on age, up to $20of military retirement pay may be exempt from state taxes.

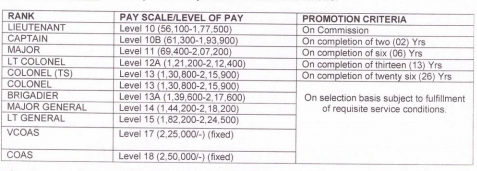

How do you calculate military pay? If you served less than three years, your. What is the salary of the Army? How much does an army officer make?

The government based your benefit amount on a multiplier of your in-service paycheck: For every year of service, the military added another 2. Eligibility for Reservists Eligibility requirements for Reservists are slightly different. Qualified Reserve Component (U.S. Army Reserve and Army National Guard) personnel begin to draw retired pay when they have accrued qualifying years of service time and reached age 60. The COSC comprising the chiefs of the army , air force and navy sent recommendations to the defence ministry on disability pension.

Forces Pension Society is a not-for-profit organisation fighting and campaigning for Service pensions rights for the armed forces and their families. Army , Air Force, Marines, Navy and Coast Guard. At the other extreme, a 4-star general with pay grade O-and years service got 1percent of his basic pay of $1800. These are the initial retirement amounts.

Social Security Administration. It was established by the United States Congress and given to veterans who meet the eligibility requirements. The easiest estimate assumes that a military pension keeps up with inflation. This eliminates the more complicated factors of correcting future dollars for inflation.

If a military pension keeps up with inflation then the pension ’s value in today’s dollars stays constant. See our COLA increase watch for the most recent updates on COLA. Army disability pension Blogs, Comments and Archive News on Economictimes. Veterans Disability Rates Additionally, veterans who were injured or became ill while serving in the military may qualify for VA disability compensation. Griffin said about one out of every four Arizonans who get military pensions was an officer.

View current VA pension rates for Veterans, including VA Aid and Attendance rates. It is not intended to provide you with financial advice. Armed Forces Compensation Scheme 10.

Continued Communication with Army Retirees. A message about Army Knowledge Online from Army LTG Howard B. Bromberg, the Army G-1. FIND IT FAST Pay Schedule. Yet in addition to paying veterans a monthly income, the VA also offers a survivor pension for military spouses and children.

To qualify, both the veteran and the family. Which states don’t tax military retirement pay? You may be surprised to learn that states do not tax any of your military retirement pay, while states offer special considerations for military retirement income or other pension plans. Go to the How to Read Pension Benefits Rate Tables page to learn how to read Pension rates pages.

The first stays on active duty for full years to retire as an E-7. They’ll base their pension on 2. High-Three retirement system.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.