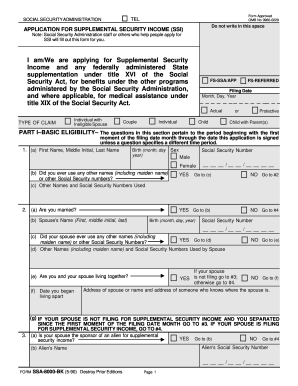

When To Complete This Form. Request for Waiver of Overpayment Recovery. Social Security Number: 2. Check any of the following that apply.

Waiver Provisions for Title II and Title XVIII Overpayments - Table of Contents. However, you do not have to pay it all back at once. SSA also provides the option of requesting reconsideration of an overpayment , but that is not covered here.

If necessary, we will help you. You can ask for a waiver at any time. If we grant you a waiver , you will not have to repay all or part of the overpayment.

In the en SSA cleared out the entire overpayment balance they claimed I owed. Sandra Gets Her Overpayment Waived – by Sandra Rick Pearson. We used to get notices of over payment all the time. How do I apply for SSA? Can you go to jail for SSI overpayment?

Name of person on whose record B. Automatic Waivers for Small Overpayments. Technicians must make all SSI overpayment waiver decisions through the Modernized Supplemental Security Income Claims System (MSSICS) via Direct Supplemental Security Record (SSR) Update. If approve you may avoid paying back some or all of the total balance the SSA says that you owe. For more information, including the appeal and waiver forms, see our article on how to respond to a overpayment notice.

A waiver is a separate and distinct remedy from challenging the existence of an overpayment or the amount of an overpayment. Download a PDF version of the Form SSA -632-BK down below or find it on the U. This article is for people who get SSI (Supplemental Security Income). If you get SSDI, you should read the article about SSDI Overpayments because the rules are different. A waiver may not be granted if, in the opinion of the authorized official, there is an indication of frau misrepresentation, fault, or lack of good faith on the part of the employee or any other person with an interest in obtaining a waiver , in connection with the overpayment debt.

Generally, the overpaid person must request a waiver. SSA waives overpayments of $0or less without development unless there is some indication the debtor may be at fault. SSA refers to these as administrative waivers. HOW DO I SHOW THAT I WAS NOT AT FAULT?

SSA calls this an “ overpayment. SSA will look at this statement very. The SSA notice should explain why SSA believes they paid too much and what action they will take. SSA may approve a waiver when the individual files the waiver form.

If SSA cannot issue a favorable decision, it must schedule a personal conference before making a decision. For overpayments exceeding $50 SSA used Form SSA -632-BK to document waiver requests and Form SSA -6to document waiver decisions. In addition, SSA policy requires that waiver approvals for overpayments exceeding $0contain a secondary peer review and signoff on Form SSA -635.

There are two types of appeals and you can do them both: request a waiver or file an appeal. Whether or not it was your fault is usually not the big issue. Get the most out of your government retirement benefits.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.