Where can I Find my SSA number? How many employees does SSA have? This option is ideal to verify new hires. The Business Services Online Suite of Services allows.

If you are navigating using only the keyboard or using an. For employers and third-party submitters who wish to submit. The no-match letter is not a notice that the employer or employee has done anything wrong.

Employers also use employee social security numbers to file state and local business taxes. A social security number is the most widely accepted identifying number that is associated with a person’s taxes. However, an employer may occasionally encounter a new hire who does not have a social security number. Social Security also offers the Consent Based Social Security Number Verification Service.

Employee Express puts federal employees in control of their payroll and personnel information. Your SSN identifies you as an individual. Double-click the employee name. Click the Personal Info tab. This happens for hotel and restaurant employees more often than you may realize.

Citizenship and Immigration Services website. Next, click “E-Verify” under the “Tools” option at the top of the screen. Then, read and consent to the Employer Memorandum of Understanding, and follow the instructions to enroll in the E-verify system. Many employers in this situation will attempt to change the SSN to all zeros but the IRS has stated that does not help SSA.

The employee may come to SSA years later with their correct information. If SSA has what was on the original W it’s easier for them to track down that information and make the corrections. An employee who chooses to contest a TNC must visit an SSA field office in person if a SSA TNC is received or call DHS within federal government working days for a DHS TNC. They also administer the Supplemental Security Income program for the age blin and disabled.

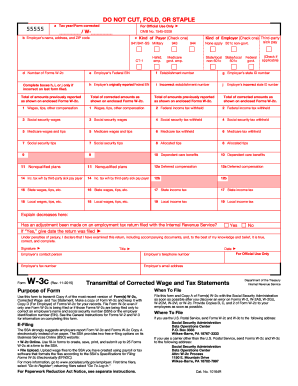

Enter your business name and contact information in Box A, your federal employer identification number in Box B and the tax year in Box C. Enter the employee’s correct SSN in Box D. If the employee does not have an SSN but has a receipt issued to him by the SSA acknowledging that an application for an account number has been receive the employee must show. The Work Number from Equifax offers social service verification services that help government agencies deliver quickly the right benefits to the right recipients while reducing improper payments and mitigating frau waste and abuse in public assistance programs. Highest number of employees expected in the next months (enter -0- if none). If no employees expecte skip line 14.

If you expect your employment tax liability to be $0or less in a full calendar year. Form 9annually instead of Forms 9quarterly, check here. Looking for the definition of SSA ? Find out what is the full meaning of SSA on Abbreviations.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.