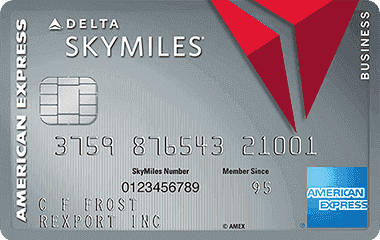

Annual Fee $the first year, then $†. Gold Delta SkyMiles Credit Card. If you fly Delta several times a year, the Platinum Delta Amex can easily be worth the annual fee. Delta and Amex are revamping their SkyMiles cards, and frequent fliers may soon notice their wallets.

Not surprisingly, the main benefits of this card are centered around Delta Air. With SkyMiles, your miles don’t expire and can take you to more than 0destinations. The bonus is worth $7based on TPG’s most recent valuations,. Plus, earn an additional 10bonus miles after your first anniversary of Card Membership. Reservation must include the Basic Card Member’s SkyMiles number.

You should plan to spend $0in purchases within the first three months to earn 60bonus miles. It will retain most of its existing benefits but undergo a series of updates. Enhanced earning rates: 2x miles at restaurants and U. Supermarkets, get rewarded whether you’re eating out or cooking in. Plus, continue to enjoy other benefits at the airport like your First Checked Bag Free.

The card comes with a $1annual airline-fee credit that you can use toward incidental charges such as baggage fees,. Card Members will earn the credit from Delta after spending $10in eligible purchases on the Card. With every Delta SkyMiles Business Car you’ll receive exclusive Card Member benefits that help you earn miles and enhance your travel experience. EMPLOYEE CARDS Add Employee Cards to your account to earn even more miles on qualifying purchases. Login here to your American Express Account, Create a New Online Account or Confirm you received your New Credit Card , to Your Account, credit card , amex.

Just like its two lower siblings, Delta has rebranded this card the Delta SkyMiles Reserve card – complete with a new look and an actual metal card. The Reserve card keeps most of its existing benefits while adding a few exciting new perks – all for a fairly hefty annual fee increase. But, you can recoup the cost of the card easily through benefits like the companion certificate and SkyMiles accumulation. Here’s how to maximize your Delta credit card’s value. Benefits: For every billing period in which you use the card for or more transactions, you’ll earn extra Membership Rewards on your purchases.

While the card has a $annual fee, benefits like a free checked bag and rental car insurance can easily make up for that cost. The card doesn't charge any foreign transaction fees, but it has a balance transfer fee of of the transfer amount, with a $minimum. I’ve been thinking about this for a while. Earn up to 70bonus miles.

Over a year to be exact. And that’s a long time to live with doubt! It seemed like a great deal. If you plan to carry a balance, avoid charge cards as they usually require that you pay in full.

Built-in Business Benefits only with the American Express. Yes, you do need to pay a lot for this card. But if you’re a frequent flyer on Delta Airlines, it may be possible to make the benefits worth the annual fee by using high-dollar perks like the Companion Certificate and the extra SkyMiles to book flights.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.