Based on this AIME amount and the bend points $9and $78 the PIA would equal $142. This person would receive a reduced benefit based on the $142. To use this program, you need to install it on your.

The formula for the Primary Insurance Amount (PIA) is the. The maximum family benefit is the. The normal retirement age (NRA) is the age at which. For someone at full retirement age (currently 66) the maximum amount is $ 8, and for someone aged the maximum amount is $ 209.

Yes, there is a limit to how much you can receive in Social Security benefits. And that amount may differ from the estimates provided because: Your earnings may increase or decrease in the future. After you start receiving benefits , they will be adjusted for cost-of-living increases. Your estimated benefits are based on current law.

The law governing benefit amounts may change because,. The best way to start planning for your future is by creating a my Social Security account online. With my Social Security , you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

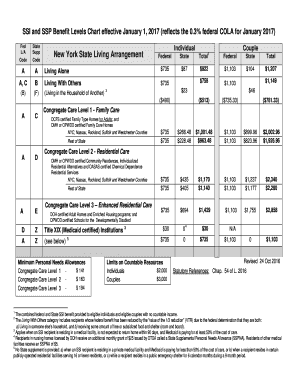

We have a variety of calculators to help you. Create your personal my Social Security account today. With your free, personal my Social Security account , you can receive personalized estimates of future benefits based on your real earnings, see your latest Statement, and review your earnings history. It even makes it easy to request a replacement Social Security Card or check the status of an application, from anywhere! The SSI payment amounts are higher in states that pay a supplementary SSI payment.

However, up to percent of your Social Security benefits, including retirement, survivor, and disability benefits (but not Supplemental Security Income) may be taxable depending on your total income. They also may not need to file a federal income tax return. Estimated Recent Average Annual Income. If they get income from other sources, they may have to pay taxes on some of their benefits. If you decided to go for your maximum possible benefit and put off collecting until age 7 your monthly payment would be $320.

You can learn more from this Social Security pamphlet. People who earned Social Security’s maximum taxable income — the amount of your earnings on which you pay Social Security taxes — for at least years of their working lives. Assuming you qualify for benefits, then Social Security determines how much it will pay you by calculating your average indexed monthly earnings (AIME), which it then uses to determine your. Social Security and SSI Benefit Amounts The new SSI federal base amount is $7per month for an individual and $1per month for a couple. The average monthly benefit paid to spouses by Social Security was $741.

Social Security Disability Insurance (SSDI) is the federal insurance program that provides benefits to qualified workers who can no longer work. The example above is for someone who is paying taxes on of his or her Social Security benefits. Usually there is an increase in the Social Security and Supplemental Security Income (SSI) benefit amount people receive each month, starting the following January. By law, federal benefits increase when the cost of living rises,. The COLA is the most commonly known increase for Social Security payments.

Data source: Social Security Administration.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.