Retiree and Annuitant Pay Dates. My Pay allows users to manage pay information, leave and. Defense Finance and Accounting Services ( DFAS ) provides.

The simplest and quickest solution for changing your mailing. Pay provides faster service, security, accessibility and reliability to all DFAS customers worldwide. Because of this delay, a well-drafted retirement order will obligate the military retiree to pay the former spouse directly until DFAS commences direct payments.

The DRAS replaced the former systems performing military and annuitant pay. If you’re active duty or in the Reserve, contact your post or base finance office first for questions about your military pay. Find out which military friendly banks and credit unions pay early. Gov – Find information on basic pay, pensions, and retirement benefits for service members, veterans, and military retirees , including whom to contact with questions and concerns. High-Calculator - This calculator estimates your retirement benefits under the Legacy High-retirement plan.

Customer service system for DFAS Travel Pay that provides real time to all customer inquires. If you have an IRA, pension, or 401(k), your retirement money is at serious risk. It contains important information about the refreshe more mobile-friendly myPay, performing a pay account checkup, verifying SBP coverage on your RAS, and helpful tools on the RA website. When will DFAS begin paying retirement pay? Is retirement pay effective the immediate 1st day of the month (as in a few days later)?

These mailing address to send us requests or information changes May 1st. Once again, it is time to look at your W-and wonder where all the money went. The opt-in period for the majority of service members closed Dec. This is the official site for Military Compensation.

If a retiree finds that something needs to be updated while viewing an eRAS, most necessary account changes can be made in minutes using myPay. Find out about insurance programs, pay types, leave options, and retirement planning. Premium Pay Limit Indicators. Prorate FEGLI Indicators. This includes months to which the member would have been entitled if the member had served on active duty during the entire period.

Taxability: This entitlement is taxable. It has a premium, and a payout in the form of a monthly payment from DFAS. Without SBP, if the retiree dies, the military retirement stops as well.

DFAS Cleveland personnel provide pay support to million people, including active duty, reserve and civilian employees of the Navy, Marine Corps, Department of Energy, Health and Human Services and the Broadcast Board of Governors, as well as military retirees and annuitants from all four Service branches. If this message is not eventually replaced by the proper contents of the document, your PDF viewer may not be able to display this type of document. For DFAS , only disposa-ble retired pay is subject to division and a former spouse cannot get more than percent of the dis-posable retired pay pursuant to a court order for property settlement. If a person gets a check for separation pay and then decides to retire, the money paid to the person in the separation’s pay is taken out of the person’s retirement pay. The designated annuitant will receive notification from DFAS if the deceased retired Sailor elected SBP.

If you are uncertain of whether an election was made, call. How to Update My DFAS Address. It pays military and civilian employees, retirees and annuitants, as well as contractors and vendors. When your account has been activated with DFAS , you will need to always keep your address. Thank you for stopping by our Estimates On-Line page, where you can compute your retired pay estimates and view your active duty pay.

The Pay estimator was created to simplify retirement pay estimates. Navy retired pay ends when the retiree dies. Survivors must promptly report a retiree ’s death to help avoid delays and possible financial hardship to surviving annuitant beneficiaries, family members or executors who will be required to reimburse any retired pay overpayments. Disposable retired pay is the gross pay entitlement, including renounced pay, less authorized reductions.

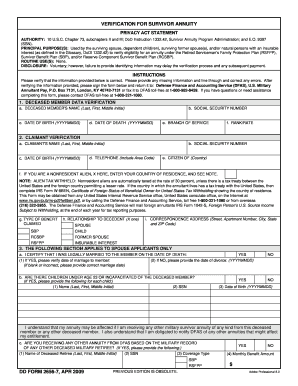

C Chapter or annuitant payments under U. The authorized deductions are: (i) Amounts owed to the United States. Notice: The identification number listed on your notification letter is required to complete this form.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.