Major study released in the past months. Depends on how many years you worke how much you earned and how much you paid in. At present, the average retiree gets.

SSI counts include recipients of federal SSI, federally administered state. If you have other sources of retirement income , such as a 401(k) or a part-time job, then you should expect to pay. How much can you earn on social security? What income is social security based on?

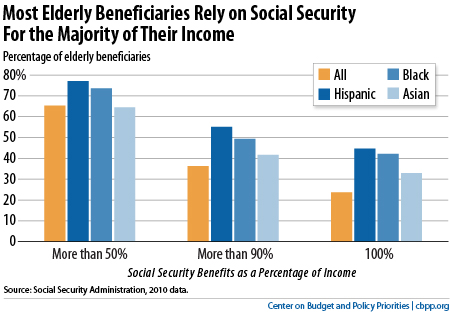

Skip the Line and Replace Your SS Card From Home. If you have an IRA, pension, or 401(k), your retirement money is at serious risk. While many retired people benefit from their 401(k) income and similar employer-sponsored retirement plans, or IRAs, the average baby boomer has just $160in retirement assets. Below are statistics on the benefits received by older adults, by average , median and relative importance.

But the benefit amounts can vary widely depending on the. Social security retirement income estimator. Specifically, Average Indexed Monthly Earnings is an average of monthly income received by a beneficiary during their work life, adjusted for inflation. Get Your Replacement Card From Home.

But those who are planning to use those benefits as their sole source of retirement income may be in for a rather harsh. However, this figure could be higher for low- income. Your average covered earnings over a period of years is known as your average indexed monthly earnings (AIME). Tax Return for Seniors (PDF). The taxable portion of the.

The SSA uses your Average Indexed Monthly Earnings (AIME) and Primary Insurance Amount (PIA) to calculate your benefits. Your benefit may be even less than this amount. In the case of Supplemental Security Income (SSI), your monthly payment amount starts out at a federally mandated number. This means, if you worked less than years of your life, the years you didn’t work will be represented as zeros in your year average. Needless to say, zeros mixed in with your average will definitely hurt your benefits package.

COLA) in their monthly benefits starting in January. If you do not have years of earnings, a zero will be used in the calculation, which will lower the average. Their monthly checks will increase by 2. Don’t get the two confused!

The earnings limit does not apply if you file for benefits at your full retirement age or beyond. Medicare Part B premiums will be $135. These charts show what that could. The limit increases each year. You will note that there is a substantial d. They also may not need to file a federal income tax return.

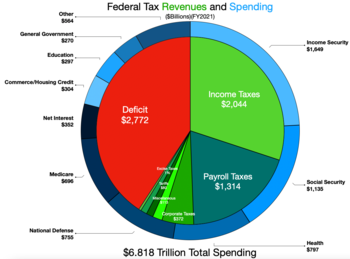

According to the the U. Census Bureau, median household income is only about $60a year and the average household income is about $10higher. How Do Benefits Compare to Earnings ? The formula used to calculate these benefits takes into account lifetime earnings over years. Average personal income tax and social security contribution rates on gross labour income Table I.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.