Who qualifies for SSI income? Do I pay taxes on social security after age 66? The federal benefit rate represents both the SSI income limit and the maximum federal monthly SSI payment. Remember, though, that not all income is countable, and so you can earn more than $ 7per month and still qualify for SSI (more on this below). DEEMING ELIGIBILITY GUIDELINES.

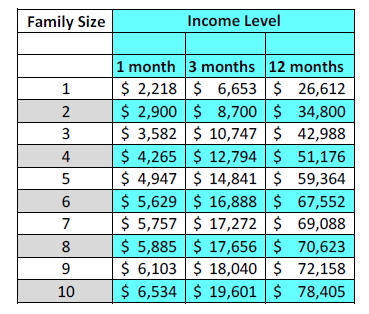

The Deeming Eligibility Chart for Children below gives the highest amount of gross monthly income for this year (before taxes are withheld) that a parent(s) can earn or receive and still have a child qualify for SSI. For students, the income exclusion amount is $8per month (up to an annual limit of $550). After that, $will be deducted from your payment for every $that exceeds the limit.

The individual amount grows by $a month, from $7to $783. Even just a small increase can go a long way. What Income Is Excluded From the SSI Income Limit? This is an increase of $279.

The SSA uses a complex calculation, a means test known as deeming, to determine the income limits for each family. Gross monthly income limit guidelines range between $0and $009. The self-employment tax rate will be 15. Individual resource limit.

Married couple resource limit. Limits on Earned Income If Claiming Early Benefits. The amount goes up each year. Medicare tax rate of 2. If you earn more than this amount, you can expect to have $withheld from your. You can find out more information on the new COLA.

If they qualify based on their own work histories, a married couple can each receive the maximum individual retirement benefit. You pay in throughout your working life, an in theory, you get benefits when you reach full retirement age. Only claimants who have minimal assets and income can qualify based on monetary criteria.

Supplemental Security Income ( SSI ) is a needs-based program. Couples are limited to $1per month. The figure is adjusted annually based on national changes in average wages.

You lose $in benefits for every $in earnings above that amount. Suppose you reach full retirement age this year. Knowing the income limits and rules can help you decide when to start taking Social Security benefits, predict the impact of taking on extra work, and help you estimate your income taxes for the year. The monthly earnings amount considered as SGA may depend on the nature of your disability. In order to qualify for SSI assistance, you must have a total monthly income that is less than those amounts.

However, the SSA uses specific countable income to quantify those amounts,. The SSDI program does not limit you in the amount of assets or unearned income you have. The Social Security Administration (SSA) does however put a limit on the amount of money that you can earn by working when you receive Social Security disability benefits. If you can earn an income, you aren’t considered disabled in the eyes of the Social Security Administration.

That means the maximum Social Security benefit you could receive is $861. If you wanted to get that same amount of income from a portfolio of retirement savings you’d need A LOT of money at the beginning of your retirement. SSI is calculated at a “single rate” or “couple rate. When both partners in a marriage receive SSI, there is a monthly maximum for their combined benefit payments. In other words, you and your spouse cannot receive more than a certain amount in SSI each month.

Get Your New Card From Home Without Hassle.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.