Complete, Edit or Print Tax Forms Instantly. No Installation Needed. Convert PDF to Editable Online. Every person who received social security benefits. Social security benefits include monthly retirement, survivor, and disability benefits.

They do not include supplemental security income (SSI) payments, which are not taxable and do not need to be reported on your tax return. It is mailed out each January to people who receive benefits. Voluntary F ederal Income Tax Withheld Box 8. Address DO NOT RETURN THIS FORM TO Box 4. The Retirement Expert will help you get the most benefits propertly.

Please tell me more, so we can help you best. IRS Notice 7will be enclosed with this form. Income Subject to Nonresident Alien Withholding. Interest and Dividend Income.

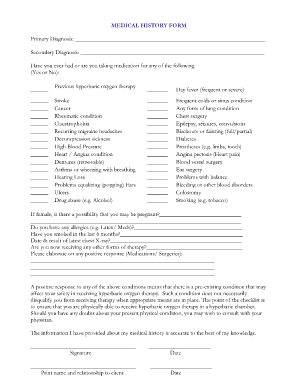

Below Boxes and there is a box entitled “Description of Amount in Box 4”. This describes how all repayments were made. However, this legend will not show reductions due to any other public disability program. See How To Get Tax Help at the end of this publication for information about getting these publications and forms. Are Any of Your Benefits Taxable?

Social Security Benefit Statement –Box Benefits Repaid. These IRS tips will help taxpayers determine if they need to do so. If line is zero or less, skip lines through 1 enter -0- on line and go to line 20. Otherwise, go on to line 2. We have made requesting or replacing your annual Benefit Statement even easier.

The SSA later authorized the RRB to pay that benefit. You also may not need to file a federal income tax return. While it may not be necessary for the dependent to file a separate return, it may be beneficial if the dependent had taxes withheld and would have a refund.

Box shows the amount of net benefits.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.