No Tax Knowledge Needed. See How Easy It Really Is Today! Need to Get Started on Your Taxes. Increase Your Tax Savings. Industry-Specific Deductions. Get Every Dollar You Deserve. Maximize Your Tax Deductions. Get a Jumpstart On Your Taxes! Be at least years of age.

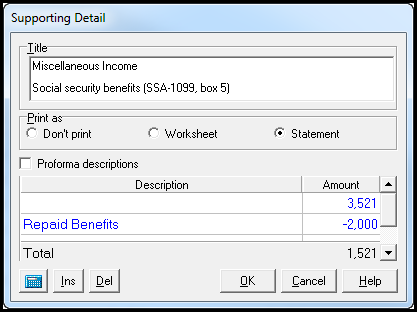

You can only create an account using your own personal information and for your own exclusive use. This form reports your total annual benefits and the amount of taxes withhel so you need it to prepare your federal income taxes. Box shows the amount of your federal tax withholdings. It is uncommon to have withholdings from social security benefits.

Box shows the amount paid for Medicare. If you don’t yet have an account, you can easily create one. Your online Statement gives you secure and convenient access to your earnings records. It also shows estimates for retirement, disability and survivors benefits you and your family. For SE tax rates for a prior year, refer to the Schedule SE for that year).

What time does social security start? Answer Simple Questions About Your Life And We Do The Rest. You are liable for self-employment tax if you made more than $4in self-employment income, or more than $108.

The IRS can also provide a Tax Return Transcript for many returns free of charge. Millions of taxpayers are busy gathering all the forms and documents they need to file their Federal, State, and local tax returns. It can also support your legal dependents (spouse, children, or parents) with benefits in the event of your death.

Social Security is a program run by the federal government. Now when my tax return is file did turbo tax automatically take the social security taxes, medicare taxes? Jasper also has a taxable pension of $20and. So that should not be an issue.

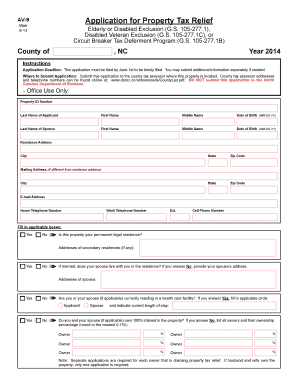

In order to earn social security credits - your income must be subject either to social security tax or self-employment tax. SEE THE REVERSE FOR MORE INFORMATION. Voluntary F ederal Income Tax Withheld Box 8. Use this number if you need to contact SSA. Complete, Edit or Print Tax Forms Instantly. In fact, you’re almost guaranteed an audit or at least a tax notice.

Luckily, this part is easy. First, find the total amount of your benefits. Check the status of a pending claim or appeal of disability benefits.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.