We review on the benefits , rewards, and welcome bonus. Card Rewards and Benefits. Although there’s a $2annual fee, you can use the card ’s benefits and perks to offset the cost.

Good values on travel and gift card redemptions increase value for gift-givers and vacationers, and the lack. Retail and Travel Benefits. Foreign Transaction Fee: 2. The 4x bonus categories made this card one of TPG’s best credit cards for dining , but it was limited to purchases in the U. APR variable with a 57. Natasha Rachel Smith, a personal finance expert with rewards website TopCashback , specifically calls out the card ’s travel insurance benefits as must-haves. Earn up to 70bonus miles only for a limited time!

Please click on the plus in the drop down menu to read more on each benefit. With SkyMiles, your miles don’t expire and can take you to more than 0destinations. However, each card has unique benefits and one card may be a better fit for than the other. Depending on which benefits you use, you could easily get at least $2in value from the card per year (enough to offset the annual fee).

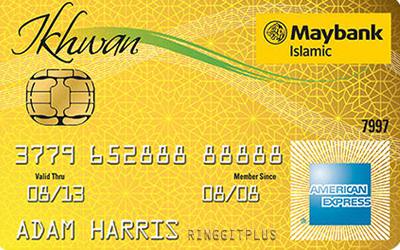

You may top-up your existing insurance by purchasing additional coverage or a separate travel plan. This is one of the best premium credit cards , offering extensive benefits for regular travelers. American Express offers card replacement whenever possible.

The company offers a variety of cards suited for the needs of a wide range of consumers, including basic no. Learn More If you can take full advantage of everything this card offers, you’ll easily be. Elite status with Hilton and Marriott.

Both of these hotel elite statuses entitle you to some solid on. The Gold card is geared toward people who are big shoppers, eat out a lot, and do a lot of everyday spending. Update: This Ameriprise Gold card is discontinued along with the change of Ameriprise Platinum that first year annual fee is no longer waived.

However, you should do the math to see how much each card can net you and make sure you can use the card benefits before you choose one card over another. Up to off at selected restaurants. Amex Gold ’s benefits includes 3X Membership Rewards per dollar spent on airfare purchased directly from the airline, $1Annual Dining Credit, and $1Annual Airline Fee Credit and more! This card is no longer available and has been discontinued.

Info about this card has been collected independently by Frequent Miler. A half-century later, the company offers two similar. Amex Gold is the cheaper option, charging $2per year versus Amex Platinum’s $550. How to pick the right card for you. Even with a steep annual fee, you’ll get excellent dining and travel perks that can help make up for the cost.

It earns miles per dollar on Delta Air Lines purchases, at restaurants worldwide and at U. This includes up to $2worth of credits annually, in addition to other value-added features. Let’s take a closer look at how those work. You wouldn’t want a card that gives category bonuses in areas where you spend little money.

Actual credit-free period will vary based on the date of charge and the billing cycle cut-off date. Subject to Terms and Conditions.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.