You may top-up your existing insurance by purchasing additional coverage or a separate travel plan. Cardmember (or a supplementary Cardmember) for the purpose of accessing the Account. However, you have to meet certain criteria and you will need to activate each of the travel insurance options. This could be a good option if you decide you do need additional coverage.

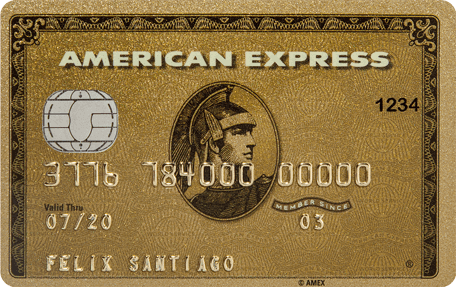

American Express” means American Express Services Europe Limited. Select the benefit you are interested in below to view the eligible Cards and benefit Terms and Conditions. This is a great addition included in the other perks. You may be able to top-up your existing insurance by purchasing additional coverage or a separate travel plan.

Finding a card that functions as a travel rewards credit card but offers generous earnings on everyday spending can be a challenge. Plus, you’ll get to cash in on one of the best travel insurance plans around. It offers the public its famous credit cards and traveler’s checks.

A lot of people don’t know however that it also offers a travel insurance that can be purchased independently. It earns two miles per dollar on Delta purchases and mile per dollar on all other eligible purchases. Travel Insurance As a Card Member you can enjoy peace of mind when you are on the roa thanks to travel protection for you and your baggage. Whether you prefer cooking your own meals or dining out, you can easily rack up Membership Rewards points. The 4x bonus categories made this card one of TPG’s best credit cards for dining , but it was limited to purchases in the U. Can Protect Your Travel Investment.

Just use your card for all your purchases. Plus, it comes with several travel protections and credits that can help offset its high annual fee. With four points per dollar spent at restaurants worldwide and U. AMERICAN EXPRESS INSURANCE LOCATIONS. Gold is looking better than ever. For example, the rental car insurance you get with the card is secondary, which means it only applies to expenses not covered by other insurances you have.

APR variable with a 57. The $250-annual-fee card earns points per dollar spent at restaurants worldwide, points per dollar spent at U. Simply charge your airline tickets, hotel and other expenses to your Card to enjoy this complimentary coverage, which extends to loss of deposit, accident, travel inconvenience insurance, as well as overseas accident hospital cash insurance. This document does not supplement or replace the Policy. Now first year €8 plus 5Miles!

All reviews are prepared by CreditCards. Opinions expressed therein are solely those of the reviewer. The information, including card rates and fees,. Optional comprehensive Top-up cover is available at a discounted rates. The annual fee may seem a bit high, but it offers benefits that help justify the fee such as a $1airline fee credit.

Accidental bodily injury - bodily injury caused by an accident of external origin occurring during the period of insurance and being the direct and independent cause of the loss.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.