Who is eligible to participate in the plan? How do I enroll in an employee stock purchase plan? How much can I contribute to my ESPP ? How often can I change my payroll. Use the Need Help links to the right to change your login information. Participant Number is your Username and if you created a PIN previously, it is now considered your Password.

Upon selling shares, you may have taxable ordinary income to report, in addition to any capital gains or losses. ESPP ) does a taxable event occur. Follow the steps outlined in this document to help you determine the IRS tax-reporting requirements. Employee Stock Purchase Plan. So here’s a snapshot of the key steps to be aware of throughout the life cycle of your plan.

Select the links for greater detail. Recordkeeping and administrative services for your company’s equity compensation plans are provided by your company and its service providers. What are ESPP stock options? You may request that net cash held as U. Fees and other charges may apply. If you have an account on Fidelity.

If those conditions are met, here are steps on how to trade in order to sell your shares. Once you have enrolled in the ESPP , you may visit NetBenefits. I read some reddit posts and still it is not clear to me. Learn more about mutual funds at fidelity.

I have an ESPP deduction on my paycheck that goes into a company cash holding. This cash is displayed on the ESPP account in Quicken. This page will open in a popup window.

All fields are required. Can I just put the adjusted cost basis in box 1e (cost basis)? See attachment for the screenshot. I sold all stocks within a year anyway, so they are taxed at ordinary income tax rate, right?

There should be no differen. Fidelity Designated Beneficiary Form and Agreement (PDF). To learn more about ESPPs, watch this brief video , and go to this page on Fidelity.

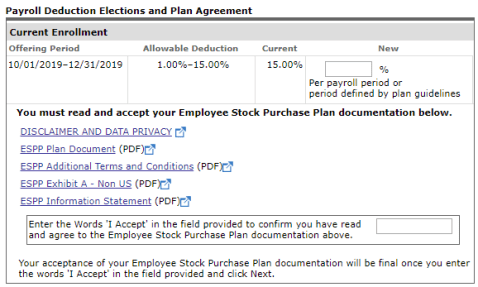

After you enroll and the offering period begins, a percentage of your pay is deducted from your paychecks and used to purchase an equivalent amount of discounted Sysco stock in quarterly offering periods. We offer a discount at the end of the six-month purchase period. Relative TSR Web-based Valuation Model.

One of the most powerful benefits that any publicly traded company can offer its employees is the ability to purchase stock in itself. Hi all, I am a fresh grad out of college and I just started my first job. Im confused how to prioritize 401k, Roth IRA, and the ESPP.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.